If you’re struggling with paying for your teen’s college education...

This Booklet could be the answer to your prayers.

If you’re struggling with paying for your teen’s college education...

This Booklet could be the answer to your prayers.

Kenneth Marc, Financial Aid Expert

"When I was in college I worked in the Financial Aid office, and learned all the tricks of the trade about how to graduate debt free, (and even did it myself)." Now I help thousands of parents and their kids do it too."

Dear Overwhelmed Parent,

Not sure how you’re going to pay for your college-bound teen’s education? Read on…

Many believe loans are their only real option to paying for school. Not true!

I know, because I used to work in the Financial Aid Office, and graduated debt free.

Knowing these Insider Secrets to Graduating College Debt Free... (What the Financial Aid Office Won't Tell You) will forever change how you approach getting financial aid for college.

"With this information, you won't make vital mistakes that could end up losing your son or daughter thousands of dollars in aid for school."

~ Angie (parent of a college freshman)

"One of the main reasons why I accrued so much debt was because my parents didn't save enough money for me to go to college. So I wound up using student-loans to not only to pay tuition, but to also take care of living expenses that my part-time job, (which paid $8 per hour), couldn't cover."

-Kristin N.

(graduated with over $58,000 in student-loan debt)

So you didn't save, or your EFC (Expected Family Contribution) is too high?

Anyone following these secrets, can graduate completely debt free

(even if you don't have a 4.0 GPA, or are not a star athlete).

How I Graduated Debt Free...

When I first went to college, I had to move back in with my parents after being away in the military and on my own.

It felt embarrassing. After all, I thought the GI Bill would fully pay for my entire college education and I didn't have to worry, right?

Wrong!

I got lucky because I qualified for the Federal-Work-Study program and was offered an on-campus position in the Financial Aid office.

Little did I know that this minimum wage job was going to turn into literally tens of thousands of dollars for me.

When I accepted the position, I had no idea I would learn all the tricks of the trade, including how to apply for my own scholarships and graduate completely debt-free.

That was probably the luckiest break I ever received.

And now, I'm paying it forward by sharing these Insider Secrets to Graduating College Debt Free... (What the Financial Aid Office Won't Tell You) with you.

Learning these Insider Secrets blew me away!

It took me years of working in the financial aid office to learn all of them, and I'm honestly shocked that they aren't more well known...

...but others are teaching you the wrong things (mainly because they don't know any better), which is why you're failing (and the current student-loan debt is roughly $1.7 Trillion!).

The system is designed to keep you borrowing money.

So I've taken all these secrets and condensed them into this Special Report for you to learn in about 10 minutes of reading.

-

MUST KNOW INFORMATION.

- The hidden resource only Financial Aid Administrators have access to and how YOU can gain access to it.

- The truth about financial-aid funds: What the office won’t tell you could mean the difference between graduating debt free, and owing tens of thousands of dollars in student loans.

- Plus, the secret to finding out about scholarships and grants that only the financial aid office knows about.

-

THE RIGHT QUESTIONS TO ASK.

- The 14 secret questions you MUST ask your financial aid administrator. The answers to these questions are essential to succeeding in getting the financial aid you desperately need.

- Plus, the one question you always want to ask no matter who you’re talking to when it comes to financial aid; or scholarships.

-

THE BEST RESOURCES TO SEARCH.

- The secret resource I PERSONALLY used to graduate debt free.

- PLUS! The one HIDDEN OFFICE on every college and university campus that hands out financial aid and scholarships like candy that nobody knows about. (Hint: It's not what you think).

The "Insider Secrets to Graduating College Debt Free... (What the Financial Aid Office Won't Tell You)", special report is filled with information not generally known to the public.

- How to convince your college to give you more money for school in one easy step - A little known secret overlooked by 99.9% of students.

- How to attain Independent-Student status so you don't have to list a parent's income; thus qualifying for more aid (EVEN IF the student still lives with their parents).

- Did you know college tuition is negotiable?

1. Three secret negotiation tactics from an Ex-Financial Aid Officer to persuade your college into giving you lower tuition rates.

2. And why doing this one thing will blow your whole chances of getting a better offer.

- One trick that will shave hundreds of hours off of finding scholarships and grants for school.

- The single most important thing you must do to avoid having your financial aid reduced when your student is working an on-campus job.

- Most financial aid award letters will offer you as little as possible. How to access the secret pool of money financial aid administrators have access to, but will never tell you about (unless you ask).

- Plus, what to do when you get a lousy award-letter, and how to fix it.

When it comes to paying for school, are you in crisis?

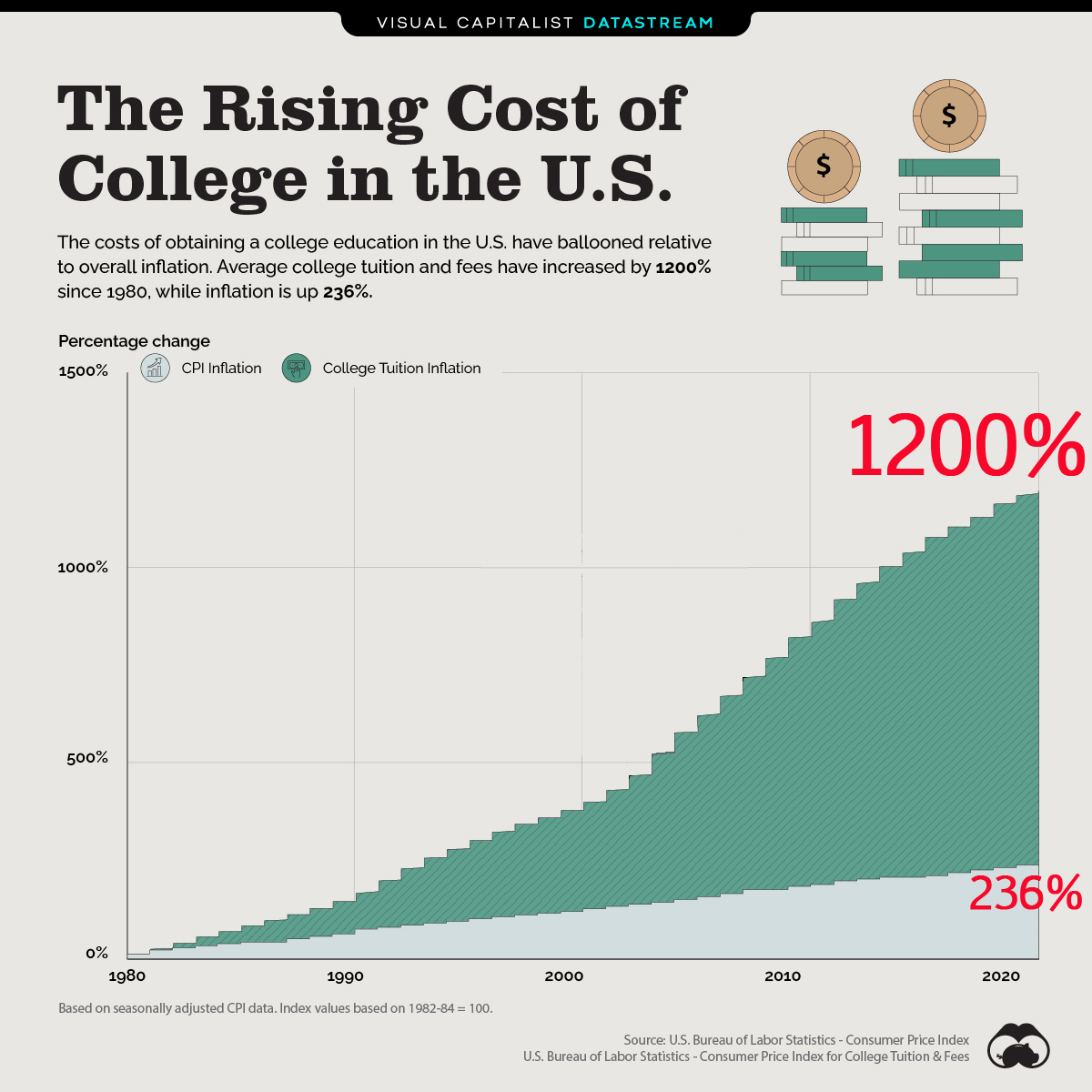

The average cost of tuition and fees for the 2023–2024 school year is $42,162 at private colleges, $10,662 for in-state residents at public colleges and $23,630 for out-of-state students at state schools.

With these higher tuition costs, students are giving nearly equal weight to price and academics when making their college selection.

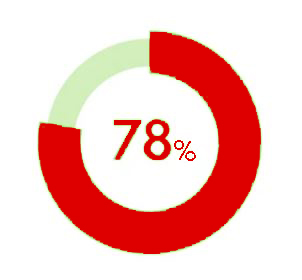

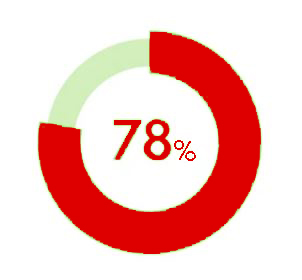

of families say they eliminated a school from consideration based on cost, according to the 2023 Sallie Mae survey How America Pays for College.

The true price of a college education is usually hidden. While most students get at least some financial aid, prospective students usually don’t know how much aid they will get until after they are accepted to college.

This makes comparison-shopping across a wide swath of institutions impossible.

Application fees and time, constrain the number of colleges each student can apply to, so the number of schools among which a student can compare prices may be as little as one.

Knowing that students will have few alternatives by the time they actually see what they will pay, colleges have every incentive to be stingy with financial aid.

If any of this describes you, then you must read my special report

“Insider Secrets to Graduating College Debt Free...

(What the Financial Aid Office Won't Tell You)".

With these higher tuition costs, students are giving nearly equal weight to price and academics when making their college selection.

of families say they eliminated a school from consideration based on cost, according to the 2023 Sallie Mae survey How America Pays for College.

The true price of a college education is usually hidden. While most students get at least some financial aid, prospective students usually don’t know how much aid they will get until after they are accepted to college.

This makes comparison-shopping across a wide swath of institutions impossible.

Application fees and time, constrain the number of colleges each student can apply to, so the number of schools among which a student can compare prices may be as little as one.

Knowing that students will have few alternatives by the time they actually see what they will pay, colleges have every incentive to be stingy with financial aid.

If any of this describes you, then you must read my special report

“Insider Secrets to Graduating College Debt Free... (What the Financial Aid Office Won't Tell You)"..

This knowledge is already changing the lives of parents and students everywhere.

This knowledge is already changing the lives of parents and students everywhere.

Insider Secrets to Graduating College Debt Free...

(What the Financial Aid Office Won't Tell You)

A real answer to a complicated problem

Imagine waking up and not having to worry about your son or daughter struggling to pay off $100,000 of student loan debt!

Imagine this whole process becoming less overwhelming because you'll have real-action steps you can take to solve this problem once and for all!

How would that feel?

Imagine having all that stress and worry dissolve!

With this special report, you'll learn the TRUTH about financial aid, and how YOU too can afford the most expensive private college for the same cost as a community college.

- Is your financial aid package not enough to cover all your expenses? One 5-minute task you can do to Fix it/ Get More Aid.

- You can only pick schools you can afford to attend, right? Wrong! Why you should absolutely ignore the sticker price, and not let it influence you in the decision making.

- Why trying to reduce your EFC is a waste of time, and what you should be doing instead.

- If the school doesn’t offer you merit aid, you’ll have to resort to student loans right? Wrong! There are 4 additional ways to get aid besides the school itself, and this Booklet reveals them all.

(Before your aid is given to another student).

Plus... when you purchase today, I'll throw in two very special bonuses!

BONUS # 1 Free access to my Free College Formula private Facebook Group!

Free College Formula is a private, invite-only, Facebook group for parents who are struggling with paying for their teen's college education. Led by a former financial aid officer and expert on how to pay for college without loans, this is a golden opportunity to learn from, and share with other parents going through the same process in a community setting.

Don't suffer alone! Follow along with a group of like-minded parents all going through the same process.

BONUS # 2 Free access to my 5 Strategies to Paying for College Debt Free video!

Graduating debt free is a 5-step process. In this special video, I break down and explain the exact 5 steps you will need to follow in order for your son or daughter to graduate completely debt free.

This applies to everyone, regardless of where you are currently in the process. So, even if your teen is already in college, I guarantee you will learn what you have been missing in order to graduate debt free.

SPECIAL REPORT

Insider Secrets to Graduating College Debt Free...

(What the Financial Aid Office Won't Tell You)

Get instant access to this e-Booklet now!

Secure Order

256BIT – Encryption

Please Note:

All sales are final, and we DO NOT save your credit card information. Authorize.net is a payment gateway that "saves" information in order to transmit it between banks for processing on secure servers. We have absolutely no access to this information other than your name, email address, and the transaction ID.

We hate SPAM and promise to keep your email address safe.

© 2024 Paying for College Debt Free, LLC. All Rights Reserved.